Value Added Tax (VAT) is a significant component of the UK’s tax system. Whether you’re a business owner or simply an individual curious about how VAT works, this guide will break down the intricacies of UK VAT, including rates, thresholds, registration, filing, VAT periods, and various schemes. By the end, you’ll have a solid grasp of how VAT impacts your financial dealings.

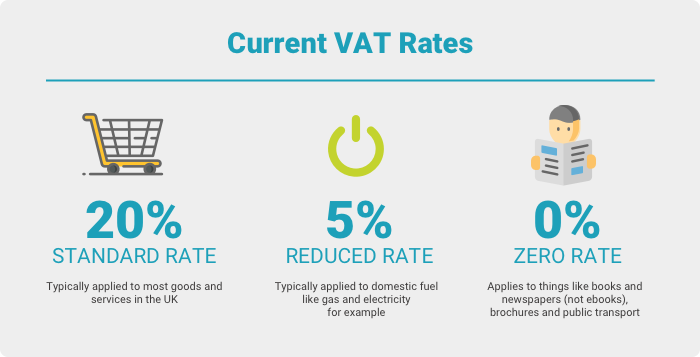

## VAT Rates in the UK

In the United Kingdom, VAT is applied at different rates, primarily 0%, 5%, and 20%, along with exempt transactions. Here’s what each rate signifies:

1. 0% VAT: This rate applies to essential items such as most food, books, children’s clothing, and public transportation. Essentially, these goods and services are tax-free to ensure affordability.

2. 5% VAT: A reduced rate of 5% is typically assigned to certain goods and services, including home energy, renovation of residential property, and sanitary products.

3. 20% VAT: The standard rate of 20% is the most common, applying to most goods and services. It includes items like electronics, luxury goods, and general services.

4. Exempt from VAT: Certain goods and services are exempt from VAT altogether, such as health and education services. This means that no VAT is charged on these transactions.

## VAT Threshold and Registration

Understanding the VAT threshold is vital for businesses. In the UK, if your taxable supply exceeds GBP 85,000 within the last 12 months or is expected to exceed this threshold in the next 30 days, you must register for VAT. Here’s what you need to know:

Registration Deadline: If you meet the threshold, you are required to register for VAT within one month of crossing it. Late registration can result in penalties, so it’s crucial to stay on top of this requirement.